Limited Liquidity: Lots of the alternative assets which can be held within an SDIRA, like real estate property, personal fairness, or precious metals, may not be very easily liquidated. This may be a difficulty if you have to accessibility money immediately.

And because some SDIRAs which include self-directed regular IRAs are matter to demanded least distributions (RMDs), you’ll should system forward making sure that you might have ample liquidity to meet The foundations set by the IRS.

Bigger Expenses: SDIRAs usually come with better administrative costs in comparison to other IRAs, as specific aspects of the administrative method cannot be automated.

Complexity and Obligation: Using an SDIRA, you've far more Management over your investments, but You furthermore may bear a lot more duty.

The tax rewards are what make SDIRAs interesting for many. An SDIRA may be the two classic or Roth - the account style you end up picking will rely mainly with your investment and tax technique. Test using your economical advisor or tax advisor for those who’re Doubtful which happens to be finest for yourself.

Due Diligence: It is really named "self-directed" to get a reason. Using an SDIRA, you're fully liable for comprehensively investigating and vetting investments.

A self-directed IRA is definitely an very effective investment auto, nonetheless it’s not for everybody. Because the declaring goes: with great electrical power arrives fantastic accountability; and by having an SDIRA, that couldn’t be more legitimate. Continue reading to master why an SDIRA could possibly, or might not, be for you.

Be in charge of how you develop your retirement portfolio by using your specialized information and passions to take a position in assets that in shape using your values. Bought skills in real estate or personal fairness? Utilize it to aid your retirement planning.

Creating by far the most of tax-advantaged accounts allows you to keep more of The cash that you invest and earn. Depending on whether or not you end up picking a traditional self-directed IRA or a self-directed Roth IRA, you have the opportunity for tax-absolutely free or tax-deferred progress, provided sure disorders are satisfied.

As soon as you’ve discovered an SDIRA company and opened your account, you may well be asking yourself how to truly start investing. Knowledge both the rules that govern SDIRAs, and also ways to fund your account, might help to lay the foundation for the way forward for prosperous investing.

When you’re trying to find a ‘set and forget’ investing approach, an SDIRA possibly isn’t the best decision. Since you are in total control around each individual investment designed, It truly is up to you to execute your individual due diligence. Remember, SDIRA custodians are usually not fiduciaries and cannot check my reference make tips about investments.

Shopper Assist: Search for a company that offers committed support, like usage of well-informed specialists who will solution questions on compliance and IRS procedures.

Including dollars directly to your account. Remember that contributions are topic to annual IRA contribution limits established by the IRS.

SDIRAs are often used by fingers-on buyers that are willing to tackle the pitfalls and responsibilities of choosing and vetting their investments. Self directed IRA accounts may also be perfect for buyers who've specialized expertise in a distinct segment market that they want to invest in.

At times, the service fees related to SDIRAs might be bigger and much more challenging than with an everyday IRA. It's because of your increased complexity connected with administering the account.

Number of Investment Options: Make sure the service provider allows the types of alternative investments you’re interested in, for example housing, precious metals, or personal fairness.

Higher investment selections means you may diversify your portfolio beyond stocks, bonds, and mutual funds and hedge your portfolio in opposition to sector fluctuations and volatility.

Have the liberty to invest in almost any sort of asset having a chance profile that matches your investment tactic; including assets which have the potential for a greater charge of return.

IRAs held at banking institutions and brokerage firms supply constrained investment possibilities to their shoppers given that they do not need the experience or infrastructure to administer alternative assets.

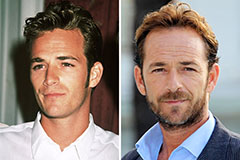

Luke Perry Then & Now!

Luke Perry Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!